tax on forex trading philippines

IM Academy Forex Trading was created in 2013 as a small start-up by Christopher Terry an independent businessman and Isis de La. Due to many complaints from consumers the Securities and Exchange.

Guinea Personal Income Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Tax-free countries spread betting tax-free countries are the Bahamas United Arab Emirates Brunei Monaco Turks and Caicos The British Virgin Islands Oman and Vanuatu.

. Forex Trading Tax Philippines litecoin tradingview. Use a device that offers you Internet access. Tax On Forex Trading Philippines.

Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as short-term. If you trade CFDs then you are subject to capital gains tax CGT on gains from your trading activities. Unlike trading locally where the tax is being imposed on the transaction itself whether gain or loss here income from foreign sources ie income from forex trading is the one being tax.

AvaTrade - Best Beginner Forex. On October 30 2018 the Philippines Securities and Exchange Commission SEC Issued its latest advisory stating categorically that Forex. But please dont subscribe to people who are trying to sell you courses for expensive prices.

The best time to trade forex in the Philippines is when the forex market has two trading sessions opened simultaneously. January 10 2019. Taxpayers who fail to secure a TRC shall not be allowed to claim foreign tax credits in excess.

Tax in Philippines for Forex Trading. My answer to that is yes also a forex trader pays taxes on his earned assets. Find an online forex broker that is licensed to operate in the Philippines.

Forex Trading Tax Philippines litecoin tradingview. It published an advisory that outlawed forex trading due to fraud and consumer losses. Open a margin account.

Forex Trading Tax Philippines litecoin tradingview. Generally it is called the overlap timings. Trading in stocks in the Philippines is popular but forex trading has a chequered past in the island community.

CGT is 10 for basic rate taxpayers when total income is 12571 to. How to trade the forex market using the see saw and 2. Traders often wonder whether forex trading is subject to taxation in the.

Anything that you earn in profits over 1000. Tax On Forex Trading Philippines. Forex trading tax philippines.

The PSEi decreased 406 points or 570 since the beginning of 2022 according to trading on a contract for difference CFD that tracks this benchmark index from Philippines. 200 PM to 600 PM. It allows you to earn up to 1000 of extra income tax-free.

On the other hand if they decide to file their. 2 are out now so be sure to check the site out for more lessons to come. Best Broker MT4 Forex Trading Platform in Philippines.

If forex trading is a side gig you are covered by the Trading Allowance. Forex Trading Tax Philippines binär optionen.

Forex Trading Academy Best Educational Provider Axiory

Foreign Exchange Market Wikipedia

Forex Trading Tax Australia Is Forex Trading Taxable In Australia

50 Pips A Day Fx Trading System Forex Trading System Strategy Mt4 Profitable Ebay

Nigeria Naira Ngn Usd Quote Forex Body Asks Dealers To Stop Hoarding Dollars Bloomberg

Philippines Taxation Of Cross Border M A Kpmg Global

Forex Trading In The Philippines Is It Legal Fermil Cervantes Fabian Ong Abrantes Law Office

Passitivity Ai Forex Trading Bot Philippines Facebook

Demo Trading Account Forex Trading Demo Accounts Online Fxcm Uk

What You Trade Can Make A World Of Tax Difference

Understanding The Tax Implications Of Stock Trading Ally

How To Avoid Forex Trading Scams In 2022 Forexbrokers Com

Forex Trading Academy Best Educational Provider Axiory

Forex Trading In The Philippines 2022 The Only Guide You Need

How Are Forex Gains Taxed Fair Forex

21 Best Forex Brokers Philippines For 2022

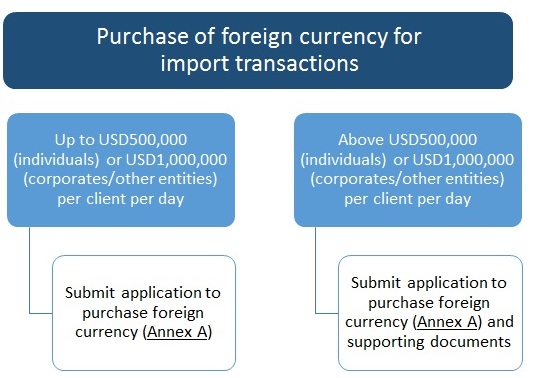

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions

/smiling-businesswoman-in-discussion-with-clients-at-office-workstation-1097995910-840608b2994d4755a82ae3a234e4ed90.jpg)